Introduction

What the company does?

Advantages of ITESOFT’s (and competitors) solutions to their clients

Business Model

Financials

Clients

Shareholders

Yooz’s sale

Competitors

Valuation

Summary

Introduction

ITESOFT is a French software company that develops applications to automate business processes through automated document reading and automated document recognition solutions. It was founded in 1984 by Didier Charpentier, CEO and Chairman of ITESOFT. The company is listed in Euronext since 2001. ITESOFT is a micro-cap with market capitalization of 17.5M€ and 21M€ in sales in 2020.

Three years ago, they launched their SaaS product, which I believe will make an important contribution to sales in the following years. I think they have been late in adopting this kind of solution for their clients, especially if you compare them with Esker, which operates in the same niche market in France. However, I think that the fact that they just started offering this solution in 2018 is what creates the opportunity to invest, because it is still a very small portion of their revenue yet. There is also the fact that it is a micro cap with very low liquidity (around 6.000€ on average).

What the company does?

ITESOFT has developed SCPA (Secure Capture and Process Automation) Digital Business Platform that is based on three pillars: (1) Omnichannel Capture, (2) Business Process Management and (3) Document Fraud Detection.

ITESOFT currently uses its SCPA platform to address the following areas:

- Supplier processes: SCPA for Suppliers

- Client processes: SCPA for Customers

Before going into the ITESOFT solutions for these areas, I would first like to give some information in relation of those three pillars mentioned before. I think it helps in understanding what ITESOFT does.

(1) Omnichannel Capture

Faced with the multiplication of communication channels (mail, FAX, paper, EDI), companies are interested in automating inbound document processes. Omnichannel capture software enables automatically processing any type of document, whether it is uploaded to a portal, received as an email attachment or digitised by an outsourcing agent. Automatic Document Recognition (ADR) engines analyse documents to determine their type while Automatic Document Content (ADC) engines automatically retrieve useful data from images.

ITESOFT omnichannal capture solution makes it possible to standardise the process whilst capturing all these documents, enabling companies to offer their clients, employees, partners or suppliers a seamless omnichannel experience.

Automatic Document Recognition

Upon receipt, the first check is to verify that the received document matches the type of document expected. Based on machine learning technologies, the ADR module automatically classifies a document from the structure or content (i.e. search of keywords, statistical analysis, etc.).

Automatic Document Content

Documents received generally contain information necessary to process a file or complete the transaction. The ADC (Automatic Document Content) module automatically extracts the relevant data from a scanned document by combining multiple reading strategies.

(2) Business Process Management

The goal of BPM is to formalise and digitise business processes to be more efficient. Automating these processes increases operational performance, for example by automatically collecting digitised information and displaying key metrics. The automation of tasks with low added value makes it possible to mobilise the skills of employees contributing actively to other high added value areas.

(3) Document Fraud Detection.

Document fraud is an intentional act designed to obtain a financial advantage or an undue service. To address the problem, SCPA’s Digital Business Platform online services can orchestrate image quality analysis tasks, detect image manipulations, identify document types, ensure the consistency of the information provided in the document and compare documents for authentication.

As I mentioned earlier, the company uses its SCPA platform to address the following areas: supplier processes and client processes. Both areas are equally important in terms of revenue, since both make around 50% of total sales.

Supplier processes

The main product to meet the specific business needs of this area is Streamline for Invoices, the company’s solution for automating accounts payable processing. This solution automates the processing of supplier invoices from capture to accounting in the ERP system through automated reading, reconciliation with orders and receipts, accounting and analytical allocation and business approvals.

By automating the processing of supplier invoices, Streamline for Invoices reduces processing costs, manages payment schedules and ensures process tracking by supplying a reliable audit trail. Thanks to omnichannel capture, the solution is able to process any invoice format (paper or electronic) all within the same process.

The solution is available on the cloud, on-premise, or in hybrid mode.

ITESOFT offers also a Supplier Portal module designed to be the single point-of-entry for all of a given company’s suppliers, enabling them to submit invoices, see payment status, contact decision-makers and even negotiate invoice discounts.

The company has five other products that cover other possible uses, such as managing purchase requests, handling supplier data creation/modification or collaboration with suppliers, among others.

Client processes

Regardless of the channel used to submit their requests, customers are no longer prepared to wait several weeks, or even several days to receive an answer. However, companies devote a great deal of time and resources to handling, sorting and distributing documents received in branch offices or mailrooms. The ITESOFT solutions manage this complexity by processing documents received by all channels on the same platform.

ITESOFT’s offering in this area is represented by eContract, a 100% online contract solution.

eContract is a packaged solution for managing contracts online, creating an entirely digitalized customer path. Customers can upload supporting documents to the portal directly, where they are verified automatically by fraud detection tools. Contractual documents are signed directly on a portal using an electronic signature that is instantly generated. Thanks to eContract, customers can establish contracts on line in a safely manner. This solution allows companies to improve their brand image, increase conversion rates and limit the risk of fraud.

The company has five other solutions to cover other use cases, like client on boarding, claims management, contract life cycles or damage management, among others.

Advantages of ITESOFT’s (and competitors) solutions to their clients

Extracted from the annual report:

- Identifying and reading documents automatically reduces the costs associated with repetitive tasks and increases reliability, notably with respect to manually entering massive amounts of data from paper documents, such as forms, bank checks, order forms, supplier invoices, and more.

- Managing documents and workflows electronically lessens the burden of administrative handling, saves times, and streamlines processes.

- Integration with the rest of the information system makes it possible to reapply human resources for more productive tasks, and above all, to improve relations with the company’s clients and suppliers, and to “un-isolate” information system silos.

- Natural integration within more global systems, that is, with the rest of the company’s computer infrastructure: proprietary business applications, ERP systems, Supply Chain Management, CRM, etc., which expands their efficiency.

Probably too long, but I think with this section and the previous one, we can have an idea of what ITESOFT does. For more information about this, I would recommend to read Esker’s last annual report, section “1.4.1. Overview of the company’s activities”.

Business Model

Current business model is based on licence sales enhanced by Maintenance and Service revenue. However, since the end of 2017, ITESOFT is focused on a transition to a subscription model, through its Software as a Service solution. This will end up being a more predictable source of revenue for ITESOFT in the long-term. Additionally, once the SaaS revenue achieves enough scale, it will end up being more profitable too.

This transformation to a subscription model is having an impact on operating margins and it will continue to do so over the following years. It is also putting some pressure on sales, because with the licence model, you get all the revenue upfront and with the SaaS product, you get a smaller amount every year, like a rent.

Apart from the sale of software, whether it is a Licence sale or SaaS, the company has two other sources of revenue: Maintenance and Services.

Maintenance

ITESOFT offers annual maintenance contracts to its clients. These contracts give clients access to the support hotline, remote maintenance, bug fixes as well as optional services, including new major version installations, on-site interventions and preventive maintenance.

According to the company, nearly all ITESOFT’s clients have signed contract agreements and renew them regularly (with a renewal rate of approximately 93%), thus contributing to the generation of recurring revenue.

Services

Services are provided to accompany licence sales and are invoiced on a man-day basis. The number of days is based on needs related to client project complexity.

It covers many different areas, such as writing requirements documents, configuring products, specific development related to integration, system installation, user and operational manager training, launch assistance and performance auditing.

The revenue generated by these services is recognized progressively as the services are performed.

Financials

Income Statement

For 2020, we just have the revenue figure, which I will disclose later.

Note 1: Revenue

As we can see, revenue has not moved much for the last ten years. The blue line below revenue refers to the current ITESOFT business for 2010 – 2012.

I make this distinction because from 2010 to 2014 there was an internal developed separated business unit called Yooz, that was sold in December 2014. For 2010 – 2012 Yooz’s revenue was 0.04M€, 0.3M€ and 0.6M€ (and 1.2M€ in 2013). For 2013 – 2014, Yooz business was reclassified to results from discontinued activities, including the proceeds from the sale, 2M€. There will be later a section explaining the Yooz sale and the current relation with ITESOFT to date.

In July 2015, ITESOFT acquired W4, a French software company in the field of Business Process Management. The company already owned 5.6% of W4 since 2005. ITESOFT acquired the remaining 94.4% of the share capital for 10M€. In 2014, W4 revenue was 4.8M€. This explains the jump in sales from 2014 to 2016.

Note 2: Adjusted EBIT

If we just look at EBIT margins, we could think that ITESOFT profitability is quite volatile. However, adjusted EBIT margins, that I will now explain, are more stable. We can see that adjusted EBIT margin has been around 10% for the last 10 years. The 2% EBIT margin for 2019 is related to 1.1M€ in expenses related to R&D development to accelerate the integration of new functionality in the company’s solutions.

Now let’s go with the adjusted items.

Note 3: Goodwill impairment losses & Acquisition and restructuring costs

For 2015, these non recurrent expenses, relate to:

For 2016, most of these non recurrent expenses, relate to:

Note 4: Yooz EBIT

Since ITESOFT launched the Yooz product in 2010 until 2014, when it was sold, the division lost money every year. So the adjustment in EBIT for 2010 – 2012 relates to Yooz EBIT losses. For 2013 and 2014, as I said before, Yooz appears in results from discontinued activities. In 2014, you see 0.6M€ in results from discontinued activities, which is the sum of the 2M€ of the sale + the losses.

Debt

The company has always had a sound financial position. During the 2010 – 2014 period, net cash was on average around 3 times adjusted EBIT. The debt levels corresponding to 2015 – 2017 relate to the 10M€ W4 acquisition.

Revenue breakdown

Geographically, the split of sales is 95% France and 5% UK. From 2010 to 2016 it was more like 90% France and 10%, but it is not a big difference.

The breakdown of revenue by type of service is as follows:

The company launched its SaaS solution by the end of 2017. This should be the growth driver of the company going forward and is what made me have a look at this company back in 2019

Recurrent revenue is the sum of SaaS and Maintenance revenue. Since 2018, the share of recurrent revenue has been increasing rapidly. The factors that have contributed to this increase in recurrent revenue are: growth of the SaaS product and a decrease in licence sales and Services.

In relation to the SaaS product, I think it is worth mentioning that 80% of the customers are new customers that have started their relationship with ITESOFT already with the SaaS product. The other 20% are old ITESOFT customers that had previously purchased the licence and had a maintenance contract in place.

The decrease in licence sales for the last 3 to 4 years is due to the new focus on SaaS sales. However, the sharp decrease in 2020 is due to the Covid crisis, since many companies have been more reluctant to assign resources to new projects. According to the company, licence sales should remain above 2020 levels. They actually said that in Q4 licence sales have already started to recover.

The decrease in Services for the last 3 to 4 years is totally related to the decrease in licence sales. As I said in the “business model” section, these services are provided to accompany licence sales and are invoiced on a man-day basis. It covers many different areas, such as writing requirements documents, configuring products, specific development related to integration, system installation, user and operational manager training, launch assistance and performance auditing. See the following example:

If the Licence price is 100€, the Service revenue to set everything up is around 150€.

With the SaaS product, the Service revenue is around 10€/15€.

The reason behind this is that the time required to set up the SaaS product is around 15 days and for the On-Premise product it takes from 1 month to 6 months.

R&D expenses

The company invests a big proportion of revenue in R&D. R&D expenses go through the income statement. Over the years, I believe the ratio of R&D expenses over revenue will decrease to a level more similar to Esker, which is around 10% of revenue.

Investments

Due to the nature of its activity, most of ITESOFT’s investment is for research and development. Therefore, ITESOFT investments have been an average of 0.5M€ for the last 10 years. Investments are comprised of investment in computer hardware and software, furniture and equipment necessary for operations.

Dividends

Clients

The company’s main clients are large private companies and governmental administrative organizations. According to the last annual report they have more than 500 customers. In 2019, approximately 33% of revenue was generated by the ten largest clients, the largest of which represents around 7% of total revenue.

In the annual reports, they have a list with their biggest clients. I will just list the ones I know:

Agri-food: Lactalis (FR), Marston’s (UK), Pepsico (UK), Pernod Ricard (FR)

Banks, insurance, retirement and pension funds: AXA (FR), Generali (SW), BNP Paribas (FR), Crédit Agricole (FR), ING Direct (FR), Société Générale (FR).

Building, construction, and materials: Crest Nicholson (UK), VINCI Construction Grands Projets (FR).

Distribution: Boulanger (FR), KIABI (FR), Intersport (FR), Yves Rocher (FR).

Energy and raw materials: Air Liquide (FR), EDF (FR), Engie INEO (FR), VEOLIA (FR).

Industry: Faurecia (FR), Mitsubishi Electric Europe (UK Branch), Polyone (FR, BE, LU, DE, ES, IT, US), VALEO (FR, DE, ES, PO).

Laboratories, pharmaceutical and hospital products: Bristol-Myers Squibb (9 countries), Laboratoire Boiron (FR).

Logistics and shipping: Air France (FR), Bolloré (FR).

Services: Alten (FR), Capgemini (22 countries), Carglass (Groupe Belron, FR), Randstad (FR), SAS Institute (FR), Sodexo (FR, UK).

Telecommunications: Belgacom (BE), ORANGE (CI), Siemens Enterprise Communications (UK).

Shareholders

Yooz’s sale

What made me have a deeper look into the Yooz sale was that, curiously, the company was bought by Didier Charpentier, ITESOFT’s founder, CEO and major shareholder. Therefore, I will try to explain a little bit what Yooz is, why they sold it and what do I think about it. Perhaps, at the end of this section you might think this is a thing of the past and shouldn’t be that important. For me, understanding this and being ok with it was very important to keep trusting the Management.

In December 2014, ITESOFT sold Yooz, a SaaS-based document automation solution designed for small and medium businesses and accounting firms. Yooz was an internally developed solution that ITESOFT launched in 2010. For the period 2011 – 2013, sales were 0.3M€, 0.6M€ and 1.2M€, respectively. EBIT losses were around 1.5M€ every year.

At the time, ITESOFT managed its current business and Yooz as two distinct business activities organized into separate business units. Each business unit published its own distinct financial information. That is why I was able to adjust ITESOFT figures for the years before the sale.

According to the press release back then, ITESOFT concluded that the coexistence of ITESOFT and Yooz generated very little synergy for the group overall. Specifically, they said that coexistence did not promote either activity’s market image or highlight their respective potential to the fullest, as the solutions were marked by inherent incompatibilities, notably:

– Business model: licence sales (ITESOFT) vs. SaaS subscriptions (Yooz)

– Sales approach: large clients (ITESOFT) vs. SMEs and mid-tier companies (Yooz)

– Level of maturity: growth phase (ITESOFT) vs launch phase (Yooz)

– Need for funding: self-funding (ITESOFT) vs. need for substantial investment (Yooz)

What did I think when I realised that the major shareholder bought Yooz for himself?

I had done some research and I realised that Yooz was/is succeeding. In Yooz’s website, they claim to be growing at 50% a year and you can also see all the awards they have received. Additionally, when we look at the related party transactions section of ITESOFT’s annual reports after 2014, we can see that there is some high level of re-invoices to Yooz.

Since these re-invoices have no effect on ITESOFT’s profits, the reason why I think this table is important is that it confirms that Yooz is growing very fast.

Therefore, when I looked at all this information I thought that it was very probable that ITESOFT’s shareholders would have been better off if Didier Charpentier had not bought the Yooz business for himself. I am aware that Yooz was losing money and probably did so for the following years, but I think that ITESOFT could have borne the losses and ITESOFT shareholders would now be owners of Yooz too. And we know how these kind of growing SaaS businesses are valued today in the market.

What do I think now?

Apparently, the sale of Yooz allow them to buy W4 in July 2015. Founded in 1996, W4 was a French software company leader in the field of Business Process Management (BPM), with a recognised offering that integrated all components of a complete BPM suite. W4 was already a technology partner for ITESFOT. In fact, they had a commercial and technological partnership since 2013 and ITESOFT already owned 5.6% of W4 since 2005.

The purchase price was 10M€. It was financed as follows:

- A total of €8 million in cash, €7 million of which is through loans.

- The balance covered by issuing 437,438 new ITESOFT shares for W4 shareholders, at a unit price of 4.55€, for an amount of €2 million, representing a dilution of 7%.

The company says that if they had not sold the Yooz business, banks would not have financed the deal. The reason is that Yooz was making a lot of money. Selling Yooz, allowed bankers to see the true margins of the ITESOFT current business.

Looking at recent ITESOFT annual reports and having talked with the company, it is clear to me that W4 was a great acquisition and is a very essential part of the whole ITESOFT offering to its clients.

So this is what happened and why in relation to Yooz. I still think that it would have been great to keep Yooz, but we cannot change that. I also think that it had not sense to sell Yooz for the incompatibilities they mentioned, because you can perfectly have two business units. On the other hand, I can understand that 10M€ was a big transaction for ITESOFT and having a business unit that was losing 1.5M€ every year, made banks somehow not convinced to lend 7M€.

Regardless of all this, current ITESOFT is a great undervalued business and that is why I am invested. However, it has been important to me to understand this, since it was ITESOFT’s founder and major shareholder who bought it.

In relation to expenses re-invoiced, from 2022 onwards, it will be reduced substantially, since there will only be 2 items. The Microsoft cloud expenses and another supplier. The company believes they have more bargaining power if they buy together.

Competitors

According to the company, their competitors would be:

- Esker (France), listed company

- OpenText (Canada), listed company

- Kofax (US), non-listed company

I would add these two:

- Coupa Software (US), listed company

- SAP (German), listed company. SAP competes through Ariba, acquired in 2012.

All of them are bigger than ITESOFT and adopted the SaaS solution earlier than ITESOFT.

Whether competitor’s products are equal, worse or better than ITESOFT I do not know. However, looking at the type of ITESOFT clients I would say at least that their product is good enough. Otherwise, they would not have these blue chip clients.

I usually like to compare competitor’s valuations to the company I am analysing. In the case of SAP and OpenText, this cannot be done, since ITESOFT competing products are a small part of their businesses. I would say that Esker and Kofax are the ones just doing what ITESOFT does, although with some differences. Since Kofax is not listed, we just have Esker left.

However, I cannot use Esker valuation multiples because Esker went on SaaS in 2007 and this is what is driving the high growth in revenue. Esker deserves a higher multiple than ITESOFT, whose SaaS product just came out in 2018 and still is around 10% of the company’s revenue. Obviously, the SaaS product of ITESOFT is growing faster.

If we consider only the order-to-cash segment (customer processes), I found another competitor in France called Sidetrade, which is also in the portfolio, although with a lower weight due to valuation. Like Esker, Sidetrade revenue is almost all coming from their SaaS product, so it deserves a higher valuation too. I just own Sidetrade because, in my opinion, Esker valuation has gone through the roof.

Valuation

In order to proceed with the valuation we should first know the pricing system of the 4 business lines. This example would be an approximation for how ITESOFT prices its products/services:

Licence sale

Licence price: 100€ (one time only).

Services: 150€ (one time only). See the definition in the “business model” section.

Maintenance: 20€/year. When the client purchases the Licence, they automatically sign a maintenance contract.

SaaS sale

SaaS price: 30€/year for current customers. These customers already have an On-Premise solution + a Maintenance contract. For new customers, price would be somewhat higher than that. The typical SaaS contract is 3 years and then annual renewals.

Services: 10€/15€ (one time only).

Maintenance: 0€. It is included in the SaaS contract.

Understanding how the focus on SaaS growth will affect the other 3 business lines

Licences: The company expects that in 8 years’ time there probably will not be more Licence sales.

Maintenance: The company is making around 13M€ with these Maintenance contracts. As long as these customers prefer to stay with the On-Premise solution, the company not only will maintain these revenues, but there will be a slightly increase year over year because the company will still be making some Licence sales for the following years. However, in the very long term, Maintenance revenue should be zero. This means all clients are on the SaaS product.

If any of these customers wants to change to the SaaS product, ITESOFT will immediately earn more from this customer. Remember that the maintenance contract is 20€/year and the SaaS contract is 30€/year.

Services: The company believes it can maintain 5M€ in sales for the following years.

SaaS: So far, we have seen rapid growth:

In order to assess the revenue direction for the following year, it is better to look at the Annual Recurring Revenue (ARR), which is the annualised value of the SaaS contracts. It is not 100% precise, but it sort of works. If you look at the ARR figure for 2019, we see that it is very close to the 1.8M€ sales figure achieved in 2020. In 2020, ARR growth rate (38%) has decreased a lot compared to 2019. As I said earlier, in 2020, many companies have been more reluctant to assign resources to new projects. This has slowed the growth rate in ARR. I think we should expect much higher growth rates in ARR than we have seen in 2020. Particularly, starting from the second part of 2021.

Valuation assumptions

As I said earlier, the company thinks that in 8 years’ time there probably will not be more Licence sales. Additionally, I think maintenance sales will end up being converted to SaaS contracts. However, it is very difficult to try to predict how the 4 business lines will exactly evolve until this happens. Therefore, I have tried to imagine, with prudent assumptions, how revenues could look in 5 years time.

Note 1: Considering that ITESOFT is at a very early stage with its SaaS product, I think that the growth rates that I am considering are very prudent. Esker SaaS product, with much bigger revenues, is still achieving 20% – 25% growth over the last 6 years.

Note 2: The company thinks it can sustain 5M€ in revenues. I am being more prudent and considering 4M€.

The other assumptions would be:

Note 3: The company expects to achieve above 11% EBIT margins in 4 years. Esker, for example, has had EBIT margins around 13% for the last 6 years. They actually achieved 11% margin with 40M€ in sales in 2012. This does not mean that ITESOFT cannot achieve 11% EBIT margins with around 26M€ in sales, which are my expectations in 5 years. I just put the Esker example as a guide. I do not know how much Esker used to expend in R&D when it was smaller, but for the last 6 years it has been around 10% on sales. ITESOFT expends around 20% of sales.

Therefore, this is my estimation of revenues for the next five years:

I also consider that ITESOFT does not pay any dividend during these 5 years, which I think is very improbable. Therefore:

Upside potential: 110% – 190%.

IRR: 16% – 24%.

Price target range: 6,3€ – 8,6€.

Current weight in the portfolio is 6,5%.

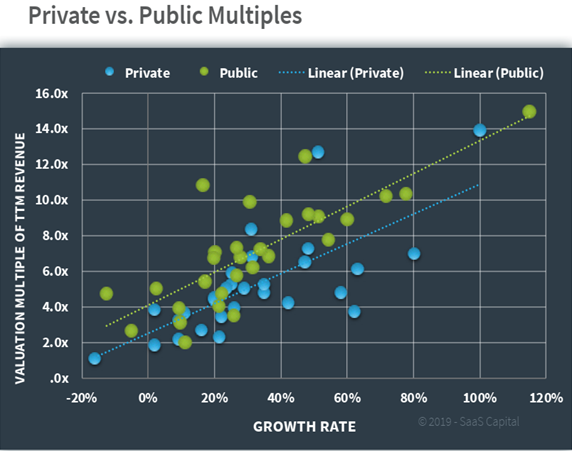

Another way to see the current undervaluation of ITESOFT is to value the SaaS business on a standalone basis. I recommend reading this paper from SaaS Capital, called What’s Your SaaS Company Worth?. SaaS Capital is the leading provider of growth-debt designed explicitly for B2B SaaS companies. This white paper is written for entrepreneurs, angel investors, and the management teams of SaaS businesses. The intent of this paper is to describe the approach used by most professional investors and strategic buyers to value a SaaS company.

This graph helps us see the average sales multiple of private and public companies in relation to their growth rate. This data has been collected from the sample used in the study. This paper is from 2019. In 2020, SaaS company valuation multiples are even higher.

I will now apply these multiples for my previous estimation of sales for the SaaS product for the next five years. I will do it using both public and private multiples:

This would be just valuing the SaaS business, excluding Licence, Maintenance and Services. Since ITESOFT’s SaaS business is very small, I think that it is better to use the private company multiples in order to value it.

Going forward, I think that the most important variable to follow will be SaaS sales. Without a doubt, this is what will drive ITESOFT’s valuation in the future.

Summary

ITESOFT has already 71% of recurrent revenue. Considering that the growth engine of the company going forward will be the SaaS product, the share of recurrent revenue only can increase over time. In recent years, business process management (BPM) has received considerable attention due to its potential to increase productivity and significantly reduce costs. This means a very good tailwind for ITESOFT (and its competitors).

Enterprise software customers tend to be very sticky. Implementing this ITESOFT’s software costs a lot of money and takes time and resources. It also takes a lot of time for employees to learn how to use the software’s tools. For all these reasons is very rare that a customer changes to another supplier. As we know, this type of moat is called “customer switching costs”.

I think that all this together with current low valuation makes ITESOFT a very interesting investment with very limited downside at these prices.

Disclaimer: The purpose of this blog is not to provide financial advice or recommendations to buy or sell specific investments. Please, do your own research before making any investment decision. If you are unsure of any investment decision, you should seek a professional financial advisor.

Some links

June 2020: Agreement with Universign

Interview with Lidl, an ITESOFT client.

Interview with UK Managing Director.

Interview with Frédéric Massy, marketing director of ITESOFT.

July 2019: Partnership with Prodware

ITESOFT twitter I also recommend to have a look at the ITESOFT Youtube channel.

ITESOFT UK twitter I also recommend to have a look at the ITESOFT UK Youtube channel.

9 thoughts on “Analysis of ITESOFT”