Before starting with the analysis of Flexopack, I would like to thank all the readers that have already subscribed to the blog.

Now let’s get on with it. The structure of my analysis of Flexopack is as follows:

- The Company

- Company’s products

- Company financials

- Significant events 2004 – 2020

- The business

- The industry

- Industry M&A activity

- Reporting and attention to shareholders

- Covid-19: First semester results 2020

- Valuation

- Summary

The Company

Flexopack is a Greek flexible packaging manufacturer for the food industry. The company produces flexible barrier films for the meat, cheese, seafood industries and non-barrier shrink films for the bottling industry. Other markets include the printing/conversion industry and personal care packaging.

The company was founded in 1979 by the Ginosatis family. Flexopack is based in Koropi (Aticca), less than 30 km away from Athens and the port of Piraeus (main port of Greece), and only in a few minutes’ drive from the “E. Venizelos” International Airport. The company is listed in the Athens Stock Exchange since 1996 and has a market capitalization of around 90M€.

Flexopack has production plants in Greece, Poland and Australia. In 2019, the company’s revenue was 89,3M€ and exports were already 87% of revenue. Main export countries are Germany, Australia, Poland, United States and UK.

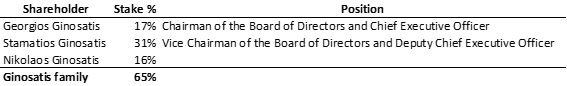

The Ginosatis family are the major shareholders of the company with a 65% of the share capital.

Company’s products

The company’s primary market is the food industry, with emphasis in meat, poultry, cheese and seafood:

- Meat:

- Poultry:

- Cheese:

- Seafood:

Company financials

On the company’s website, you can find the annual reports since 2004. From 2004 until 2019, Flexopack has grown its sales at a compounded annual growth (CAGR) rate of 8,6%, going from 26M€ to 89M€ in sales in 2019. EBIT and Net Profit CAGR have been 9,2% and 10,9%, respectively. Average gross profit margin for the period is 20,9%. Average EBITDA and EBIT margin for the period are 16,4% and 10,3%, respectively.

Income Statement

During these 15 years, sales have grown every single year, with the exception of 2009. That year sales decreased a 19%. According to the company, the reasons behind this revenue contraction were:

a) A reduction in demand for the company’s products due to the economic recession caused by the international financial crisis. I guess they had more exposure to hotels and restaurants than now, because the first semester results, as we will see later, have been extraordinary.

b) The conservative sales policy followed by the Company due to the increased financial risk. I guess they stopped some sales to clients with a bad credit profile.

c) The reduction of selling prices due to the drop in prices of raw materials.

In addition to these 3 points, in 2008 there was a change in the consolidation method for Inova Plastics, an associate company where Flexopack had (and still has) a 50% of shares and voting rights. Inova ceased to be consolidated on 30/06/2008 and since then is incorporated in the consolidated financial statements with the equity method. Therefore, while sales of Inova for the first semester of 2008 where included in the consolidated financial statements, in 2009 there were no sales of Inova in the income statement of Flexopack.

If we take out the sales of Inova for the first semester of 2008 (2,7M€), the decrease in sales for Flexopack in 2009 would have been -14%, instead of -19%.

However, this decrease in sales in 2009 had no effect on net profit. As we can see, in 2009 net profit actually increased. Probably because of the decrease in raw materials costs. As we can see, in 2019 the gross margin increased.

Sales by geography

Flexopack has been very successful in its internationalization strategy. Although in 2004 exports were already 39% of total revenue, the company managed to increase that figure to 87% in 2019. International sales went from 10M€ in 2004 to 77,5M€ in 2019, a CAGR of 14,6%.

Meanwhile, domestic sales have actually decreased. We can see that sales in Greece went from 18M€ in 2008 to 11,6M€ in 2009, and they have remained at the same level until 2019.

Balance Sheet

As we can see, Flexopack has always had a strong and healthy Balance Sheet, with an Equity/Assets ratio around 60% for the period and very low debt levels.

Shareholders’ equity has grown from 26M€ to 74M€, a CAGR of 7,2%.

Since Flexopack was listed in 1996 the number of shares has remained the same. Therefore, they have achieved all their growth just with the internal resources generated by the company all these years.

Net Financial Debt

As we can see, for the period 2004 – 2007 (before the financial crisis), debt levels were quite high. On average, above 3 times Net debt / EBITDA. Since then, debt levels have remained very low. For the period 2008 – 2019, average Net debt / EBITDA ratio has been 0,3x. The company released its first semester results in September and they now have Net Cash of 2M€, including IFRS 16, or 3M€, excluding IFRS 16.

Dividends

Another thing that I like of Flexopack is that, during these 15 years, the company has invested almost 100% of profits back into the business. We can only see dividend payments for the period 2004 – 2009 and in 2019. For 2004 – 2009, the pay-out ratio was 20%. In 2019, after 9 years without paying any dividend, the pay-out ratio was 10%. So again, almost 100% of profits have been reinvested in order to grow the business.

I especially like this a lot, because it means that the family sees opportunity to grow the business and they prefer to postpone short-term profits (dividends) in order to expand the business and increase future annual profits, making the company more valuable. And they see the opportunity big and/or clear enough that they chose to invest all profits back into the business.

Investments

Flexopack has invested 86M€ in Capex for the period 2004 – 2019. In the same period, depreciation and amortization has amounted to 52M€. I consider the difference to be growth Capex. With this “growth capex” the have managed to increase sales 3,4 times and net profit 5,1 times.

Over the years, Flexopack has been following a disciplined investment approach, which has led to continuous optimization of their manufacturing processes and distribution network, resulting in plant productivity improvements, network efficiencies and procurement savings.

The company’s investment plan targets the greater penetration of new geographic markets, through the enlargement of the production facilities, in Greece and abroad (Poland and Australia).

Stock option plan

In December 2019, the company launched its first stock option plan “for the members of the Board of Directors, directors and other Company senior executives.

The maximum number of shares that may be granted under the plan is 75.000 shares. The rights will mature within the company’s fiscal year 2022. The maturity date of the rights is set as the 29th March 2022. The exercise price of the shares is 3 Euros per right. This 75k shares represents 0,64% of current number of shares.

Related party transactions

In February 2014, the company started a private rental agreement with Nikolaos Ginosatis (shareholder with a 16,3% stake in the company), related to a property located near its production facilities, that is being used for Flexopack’s business activities. The company utilizes this property as office facilities, exhibition centre and as a warehouse facility for its products. The contract signed back then ends up in February 2023. The annual rent is 85.000 Euros.

I am not concerned with this, but I wanted to mention it. If the company decides to buy the property in order to not to pay the rent, the impact in net profit would be 1,2%. Therefore, it is absolutely not material.

Auditor

Crowe Horwath. Not a Big4, but it is in the top 10 worldwide. Hence, it is not a tiny Greek audit firm.

Significant events 2004 – 2020

Here are the most significant events for the company since 2004. Apart from that, I would like to highlight the continuous investment in R&D every year and the relevance given to the R&D department in the company. Reading the annual reports we can see the continuous emphasis in developing new products and improving existing ones. In addition to that, I would also like to mention the continuous improvement of production processes and increase of production capacity.

2007

On July 2007, the company acquired the 75% of a Polish company, Fescopack. This company’s activity was the distribution and sale of flexible packaging material. Actually, before the acquisition, Fescopack was a client of Flexopack. They distributed Flexopack’s products for the Polish market. After the acquisition, Flexopack started manufacturing its own products there.

2010

Establishment of new subsidiary company in Serbia. Only for sale and distribution.

2013

Flexopack acquires an additional 22,85% of Fescopack, achieving a 97,85% of the share capital.

February 2013: The company launches a 6,5M€ investment plan for its Polish subsidiary to increase its production capacity in order to serve the growing demand for its products. The investment plan will be completed in the first half of 2015.

2014

October 2014: Establishment of a new company under the name «FLEXOPACK INTERNATIONAL LIMITED», with domicile in Larnaca, Cyprus. The new entity, which is fully owned by FLEXOPACK (100%), will be the holding company of the international activities of the Group. According to the company, “the above action is in the context of the Company’s strategy to expand its international network of production and distribution, aiming at enlarging its market shares in targeted geographic markets with significant growth potential”.

October 2014: Establishment of a new company in Australia

December 2014: Establishment of a new company in the United Kingdom. Only for sale and distribution.

2015

The investment plan of the Polish subsidiary was successfully completed in March 2015.

2016

Increase in the stake of the Polish subsidiary to 98,32%.

November 2016: Establishment of new subsidiary company in New Zealand.

Construction of new industrial building:

- With the objective to expand its production facilities, in January 2015, the company acquired an adjacent land to the existing facilities in Koropi. The land covers an area of 9,904 square meters on which the company will construct an industrial building.

- The construction of the above industrial building, which will be a two-floor building with basement and will have production and storage spaces along with an office area of 6,975 square meters, is expected to be completed by the end of 2017.

- This new building is expected to strengthen the production capacity of the company.

2017

October 2017: The company acquires the remaining 1,68% share capital of its Polish subsidiary.

November 2017: Establishment of new subsidiary company in Australia. The above new company will proceed with the purchase of a land plot and the construction of an industrial building.

2018

October 2018: Establishment of a new subsidiary in France.

2019

Stock Option Plan to the members of the Board of Directors of the Company, senior and other executives. 75.000 shares.

2020

April 2020: Establishment of a new subsidiary in USA. Only for sale and distribution.

May 2020: Purchase of a new property in Koropi, Attica. The company purchased a land plot, which is adjacent to its existing facilities in Kropia, with an area of 9.654 sq.m. for a price of 1,5 million Euros, in order to proceed in the future with the construction of a new industrial building and consequently to further expand its production facilities.

The business

The sector in which the company operates is characterized by significant entry barriers for new entrants, due to the particular technological know-how required and the significant investments in infrastructure that are required.

Flexopack has a defensive business thanks to its stable end markets. The products of the Group are used mainly in food packaging which, since food is of first need, are usually the least affected from a consumption slowdown.

Additionally, they focus on primary packaging, which is the most critical packaging solution in the food industry. In particular, their products are in direct contact with perishable foods like meat, poultry, cheese and seafood. Therefore, the quality of Flexopack’s products are of utmost importance for their clients, mainly food processors. Flexopack’s products protect the food product from microbes, provide moisture barrier protection, prevent from any content contamination and enhance the shelf life of the product. In the end, all this is translated to the income statement, which shows an EBIT margin track record above 10% for 2004 – 2019.

Flexopack business is also very resilient, since it has shown margin stability across various input cost cycles. This shows that the company has no problem in passing through its clients any increase in the raw materials used to make their products.

Flexopack’s proven international growth platform is also of utmost importance for the business, since clients require reliability of supply wherever they operate around the world. They don’t have the scale that the big players of the industry have, like Winpak, SealedAir, Transcontinental, Amcor or Berry Global, but this is why they are using all the profits to grow the business instead of giving large dividends.

The industry

Flexopack operates in the flexible packaging market for the food industry. There is plenty of information on the Internet about the industry where Flexopack operates. I have found different market research reports that are not free but, fortunately, they publish a summary where you can find relevant information and insights.

The following paragraphs are extracted from the free summaries of three recent market research reports. I have selected the information that I find relevant to my investment in Flexopack.

According to a May 2018 market research report from Technavio called Global Flexible Packaging Market for Food and Beverages 2018-2022:

Intense competition and technological advancements pose as major challenges to flexible packaging companies. Owing to the intense competition, companies are focusing on adopting M&A strategies, where smaller companies are either acquired by or merged with major vendors.

Our market research analysts have predicted that the market will register a CAGR of nearly 6% by 2022.

According to an October 2019 market research report from Transparency Market Research called The Global Flexible Packaging Market:

Globally, revenue generated by the flexible packaging market is anticipated to reach ~ US$ 370 Bn in 2019, and is projected to expand at a CAGR of ~5% in terms of value during the forecast period (2019 – 2027).

The food sector has been the largest end user of flexible packaging, and in 2018, held a ~30% share of the global flexible packaging market. This is projected to rise over the forecast period at the rate of ~5%, and the food sector is likely to continue to hold the largest chunk of the revenue and sales in the market. This can be attributed to several benefits, including lowered production and transportation costs, customizable barrier properties, and protection of product integrity offered by flexible packaging.

Big players are increasingly focusing on strengthening their position in the market and expanding their global standing through acquisitions.

In order to align with the growing demand for sustainable packaging, players are also investing in research & development, geared towards environment-friendly materials and products.

According to a July 2020 market research report called Food Packaging – Global Market Outlook (2019-2027):

The global food packaging market size was estimated at USD 303.26 billion in 2019, exhibiting a CAGR of 5.2% over the forecast period.

Factors such as convenience and use of high-performance material are expected to aid the industry growth. Improved shelf-life, coupled with heightened efficiency in the prevention of content contamination, is expected to boost the growth of the market. In addition, factors such as increasing population, rising disposable income, and shrinking households have a positive impact on the market.

The market is expected to remain highly regulated with agencies such as U.S. Food and Drug Administration (FDA) and the European Commission imposing stringent regulations regarding use of food packaging types and food contact materials. The market is shifting toward more sustainable packing solutions such as bio-based plastics and thermoplastics, which is further expected to spur market growth.

Flexible packaging is the fastest-growing segment, exhibiting a CAGR of around 6.0% from 2020 to 2027 owing to its ability to form thinner, lighter, and compact packing. Shift in demand from rigid to flexible packing solutions is expected to boost segment growth. Superior performance and convenience offered by retortable packages is presumed to exhibit the largest demand over the forecast period.

Flexible packaging is anticipated to witness sustainable growth owing to growing demand in the developing economies. Technological innovations in product development and increasing trend of smaller package sizes are expected to fuel the segment growth. Moreover, cost-effectiveness and reduced raw material consumption are likely to boost demand over the projected period.

Industry M&A activity

The packaging industry has been a hotspot for M&A activity over the past 4 – 5 years and this trend is expected to continue for the foreseeable future. A part from reports like the ones I have previously highlighted, we can also confirm this by reading the annual reports of the big players. I found a good source of information in a report made by William Blair in October 2019. William Blair is an investment bank specialised in the packaging industry. Looking at the deals they have been involved in 2019, I would say they are among the top worldwide M&A advisors in this industry. Here are some extracts from the report that I would like to highlight:

Influx of private capital into the packaging industry has resulted in fewer publicly traded companies and intense competition for platform assets.

Investors are increasingly turning to the packaging industry for attractive M&A opportunities. Packaging M&A multiples have increased approximately 25%, or two turns (EV/EBITDA), since 2015 as the industry’s combination of favourable cash flows and relatively stable end-markets has continued to garner interest from strategic and financial acquirers.

Premium for Noncyclical Assets Expands

The demand for packaging assets is driven in part by the industry’s generally stable economic profile, strong cash flows, and relatively fragmented competitive landscape. Broadly speaking, the packaging market has witnessed median valuations widen from 8.1x LTM EBITDA in 2015 to 10.0x LTM EBITDA in 2019.

Packaging assets that serve noncyclical end-markets, most notably healthcare and food, are commanding a premium to packaging assets that focus on cyclical end-markets, such as automotive and industrial.

Robust Private Valuations Shape Dealmaking Dynamics

The number of publicly traded packaging companies has decreased by 40% since 1999. This trend, which has significantly affected M&A activity across the industry, has been driven by multiple factors.

Many large publicly traded packaging companies are pursuing M&A to drive growth to support elevated valuation levels.

Meanwhile, many promising companies are forgoing an IPO and instead electing to remain private, where there is a valuation premium and less focus on quarterly earnings and near-term initiatives. Private packaging companies today are garnering valuations about 1.5 turns higher than their public counterparts.

Financial Sponsors Place a Premium on Platform Assets

Financial sponsors have exhibited a willingness to pay up for packaging platform assets of size that support multifaceted organic and M&A growth opportunities. Financial sponsors consider many variables when targeting a potential platform investment; chief among them are a strong management team, quality operations, and a proven track record of successfully executing and integrating acquisitions.

Reporting and attention to shareholders

Before going into the first semester results for this year, I would like to comment on the company’s reporting and the attention they give to shareholders.

In terms of reporting and, having read all the annual reports since 2004, I can say that they never comment on their results. The only year they made some comments was in 2009, which is the only year that sales decreased. However, reading about the investments they make, the “significant events of the year” section of the annual report and looking at the numbers, we can see that the growth comes from their successful international expansion.

I explain this because this year, for example, it would have been very helpful to know how exposed they are to supermarket sales and food service sales (hotels, restaurants, etc.). However, as we will later see in the first semester results, we can make our own assumptions.

In terms of attention to shareholders. I know and have been invested in Flexopack since 2015 and, during all these years, I have just been able to speak with the company once, in May or June of this year. Like most micro-caps companies, they don’t have an investor relation department, so you normally get to speak with the CEO and/or CFO, which is way better by the way. However, I have send around 7 – 8 emails to Flexopack during these 6 years in order to contact with them and never got an answer, until May of this year. I was able to speak with a member of the Ginosatis family which is on the Board of Directors.

It was clear to me that they are very jealous of giving information to the market, outside what you have to publish to comply with reporting regulation, of course. Since Flexopack is so far a successful story, I assume that they don’t want competitors to know too much about them. And I actually understand it perfectly.

Although I would like to have annual reports and beautiful investor presentations like those of the big industry players like Winpak, Sealed Air, Transcontinental, Amcor or Berry Global, I know that, it is precisely this lack of information and beautiful reporting what makes Flexopack an unknown company for the investor community. This is one of the reasons the stock is cheap. Obviously, this is not just with Flexopack, this happens with many micro-caps. However, I totally believe it is an advantage for those private investors that want to go out and do the work.

Covid-19: First semester results 2020

Like many small companies, Flexopack only publishes first semester and annual results. The 16th of September they published their first semester results for 2020.

As we can see, the company keeps its positive trend of growing revenue and profits.

In the report, the company mentions the following in relation to Covid-19:

Based on the data in force at the time of preparation of this Financial Report, no substantially negative impact exists on the Company’s business activity and in particular on its production, sales and supply chain.

It would be very helpful if they could give more information, but just looking at the numbers, we can see that they have been positively affected by Covid-19.

Flexopack sells its products mainly to food processors. However, we don’t know which percentage of its sales end up in supermarkets or in the food service channel (hotels, restaurants, etc.). Looking at the first semester sales figure I assume that almost all of their products end up in supermarkets, otherwise it would have been impossible to have a 14% increase in sales if they have a big exposure to food service. This made me have greater conviction in Flexopack, because now that we are seeing lockdowns again in Europe and North America, it is good to have (cheap) stocks in your portfolio that do even better in this environment. And during the march and april lockdowns, supermarkets where almost the only game in town in the food industry. We can also see that, while revenue has increased by 14%, cost of sales has just increased 8%, expanding the gross profit margin from 24% to 28%. The reason behind this increase in gross profit margin is the decrease of the main raw material cost for Flexopack, resin. Resins are made from crude oil derivatives, so the deep decrease in oil prices due to the Covid-19 crisis has benefited Flexopack, allowing them to buy resin at a much lower price.

Continuing down the ladder of the income statement, we can also see that operating expenses have remained flat despite of the increase in revenues.

All this has resulted in a sharp increase in EBIT margin, from 10,9% to 16,5%. EBIT and Net profit have increased 72% and 62%, respectively.

Valuation

Before going into the valuation assumptions, I will have a look into the group of listed peers and M&A transaction multiples.

Listed peers

The following table show some key numbers of a group of Flexopack’s listed peers that I have selected:

As we can see, these companies are much bigger than Flexopack, with sales going from 900M USD to 12.500M USD. However, these companies’ sales of the same products that Flexopack produces is much lower. Unfortunately, these big companies do not disclose in such detail.

In terms of indebtedness, with the exception of Winpak, the other four companies have a Net Debt / EBITDA that goes from 2,5x to 4,7x. Flexopack has no debt.

When looking at revenue growth for the last 6 years, we can see good growth in Transcontinental, Amcor and Berry Global. However, almost all these growth has been achieved through acquisitions. Flexopack’s 9% growth over the last 6 years is 100% organic growth.

In terms of average gross margin for the last 6 years, the bests are Winpak and Sealed Air. With Transcontinental I don’t really understand the 54% gross margin, because they end-up with similar EBIT margins than the rest, so it might be a difference in their accounting policy. Flexopack has an average gross margin of 23%, versus 31% – 33% of Winpak and Sealed Air. Since in this industry scale matters, this might very well be the reason for the difference. What about the 20% gross margin for Amcor and Berry, which are the biggest players? I think the difference comes from the other markets in which these two giants operate, which have lower margins than the niche markets where Flexopack, Winpak and Sealed Air operate, but this is just my guess.

When it comes to EBIT margins, the best company is Winpak. The rest are not that far from each other. Most of Winpak’s revenue comes from the same products as Flexopack. Winpak is actually its closest peer in terms of product and end-markets. Therefore, if Flexopack continues gaining scale I believe they can narrow the EBIT margin gap with Winpak over the years. Nevertheless, I don’t count with this possible margin expansion for my valuation.

Next year PER for the peer group is around 19x. We will have a look at this later for the valuation.

M&A transaction multiples

I will use this graph from the William Blair report that I mentioned previously. I have had a look to two other investment banks reports on the packaging industry and the valuation multiples are very close to the ones that appear in this graph.

Flexopack’s valuation

Number of shares (in millions): 11,7

Stock price 27/10/2020: 8,00 €

Market Cap: 94M€

Valuation assumptions:

Note 1: Considering the first semester results, it is very probable that 2020 sales figure will be above 95M€. Since I don’t know to what extent the company’s sales are being positively affected by the Covid-19 situation, I have estimated the 2020 sales figure increasing 2019 sales by 6%.

Note 2: I consider the company continues reinvesting 100% of profits back into the business.

Note 3: For the period 2004 – 2019, sales CAGR has been 8,6% and the company, as I explained earlier, sees such an opportunity for growth that they are reinvesting 100% or almost 100% of profits every year. Therefore, I consider that a 5% – 6% growth range in sales is prudent.

Note 4: For the period 2004 – 2019, average EBIT margin has been 10,3%. However, scale is slowly helping the company to achieve higher margins. For instance, in 2016, 2017 and 2018, EBIT margins have already been 11,3%, 13,3% and 12,5%, respectively. In addition, we have a very similar company, called Winpak, which has 18% EBIT margins. As I said earlier, I believe there is no reason why Flexopack cannot achieve higher EBIT margins as long as it continues to increase in scale. For all these reasons, I believe that an 11% – 12% EBIT margin range is a prudent long-term estimate.

Note 5: As we have seen before, the PER for the listed peer group is around 19x. Flexopack is organically growing at 8% – 9%, no debt and, unlike its peers, Flexopack is reinvesting 100% of profits to grow the company. For all these reasons and, also taking into account that is a much smaller company than its listed peers, I believe Flexopack deserves a 17x valuation multiple.

Note 6: As we have seen before, the average EV / EBITDA multiple for M&A transactions in 2019 for non-cyclical packaging companies is 10,7x. Considering this and the reasons exposed in Note 5, I believe Flexopack that using a 8,5x EV/EBITDA valuation multiple is prudent.

Therefore, I estimate that Flexopack’s upside potential is:

- PER Valuation: 54% – 72% upside potential in 3 years, which implies a price target range of 12,3€ – 13,8€. This implies an IRR of 15% – 20%.

- EV / EBITDA Valuation: 51% – 65% upside potential in 3 years, which implies a price target range of 12,5€ – 13,2€. This implies an IRR of 15% – 18%.

Although it is not trading, by far, at the same discount than in 2015, I still consider the upside potential to be very attractive, taking into account the growth profile and the defensive nature of Flexopak’s business, the strong balance sheet, reinvestment opportunities and the M&A sweet spot moment of its industry. For this reason is one of my top 3 positions. And if more lock-downs come around, like it is happening now, Flexopack will benefit from it, since the vast majority of its products end up in supermarkets. For this last reason, I see Flexopack as kind of a hedge if the Covid-19 situation persists more than we initially thought.

Summary

- No debt

- Strong balance sheet (equity = 66% of total assets)

- Family-owned

- High EBIT margins

- Best organic growth among any if its listed competitors

- Exports are already 87% of sales

- Reinvestment of 100% of profits. Shows the family sees big opportunity to continue to expand internationally.

- Disciplined investment approach. Continuous improvement of production processes and increase of production capacity.

- Opportunity for margin expansion as they gain scale

- Significant entry barriers for new entrants

- Continuous investment in R&D –> source of competitive advantage

- Defensive business thanks to its stable end markets

- Critical packaging solutions. The quality of Flexopack’s products are of utmost importance for their clients.

- Margin stability across various input cost cycles.

Risks

Plastic regulations. Regulations regarding use of food packaging types and food contact materials. However, I believe that in the niche market where Flexopack operates, players will be the last ones affected in the packaging industry by plastic regulations for packaging. Why? Because there is not yet any available and competitive substitutive product to plastic as primary packaging for meat, poultry, cheese or seafood. Nevertheless, Flexopack is also working towards the finding of more sustainable products, so it is not that they are resting on their laurels.

Why can we find this defensive and growing company at this price then?

I think the stock might be cheap for the following reasons:

- Greek company. However, only 13% of domestic sales.

- No analyst coverage.

- Micro-cap company (94M€ market cap). Not important for a private investor or a small fund.

- Very illiquid stock

- Very boring annual reports with very little information about the business or its industry.

Disclaimer: The purpose of this blog is not to provide financial advice or recommendations to buy or sell specific investments. Please, do your own research before making any investment decision. If you are unsure of any investment decision, you should seek a professional financial advisor.

12 thoughts on “Analysis of Flexopack”